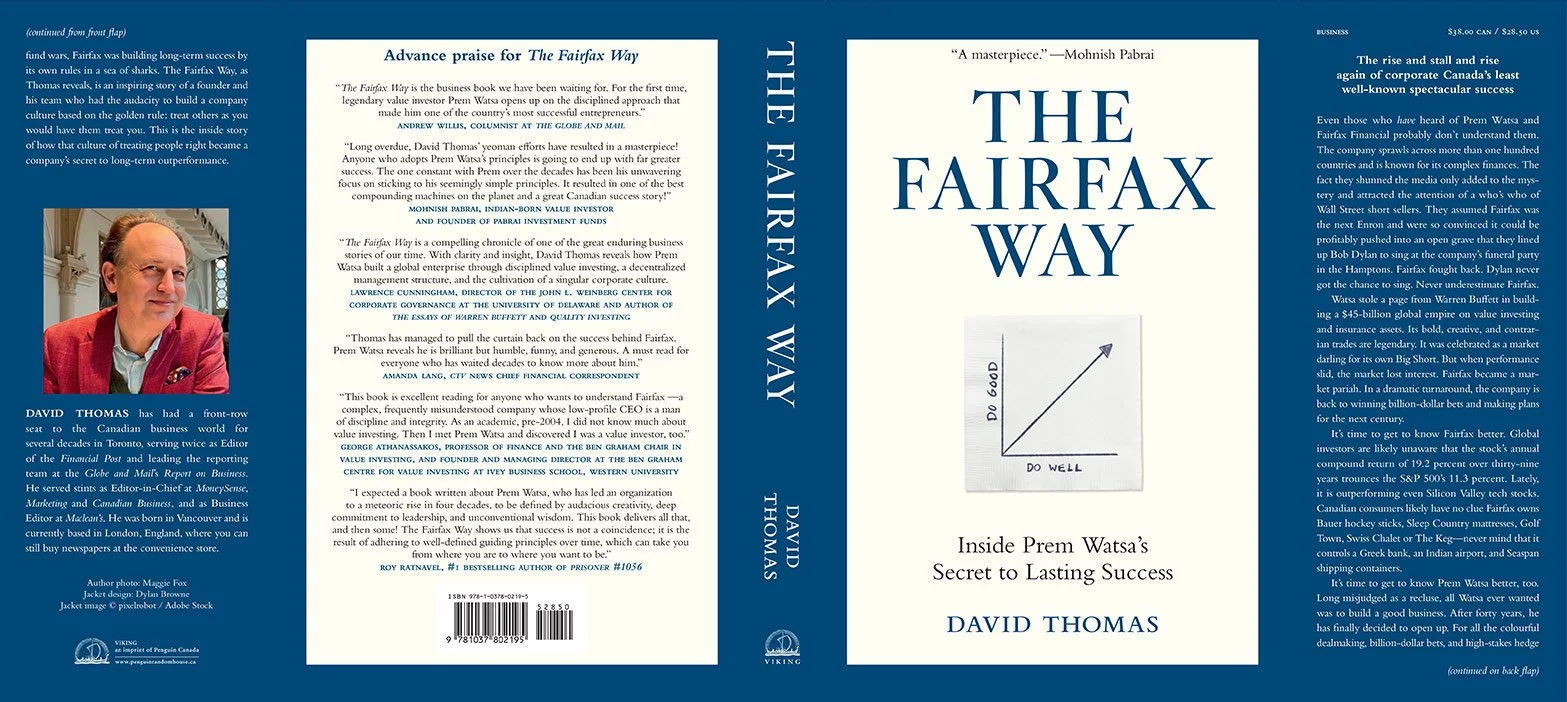

The Fairfax Way

The rise and stall—and rise again—of corporate Canada’s least well-known spectacular success

Even those who have heard of Prem Watsa and Fairfax Financial probably don’t understand them. The company sprawls across more than 100 countries and is known for its complex finances—so complex, they once attracted a who’s-who of Wall Street short sellers who misread the company as the next Enron and decided it could be profitably pushed into an open grave. The hedge funds even had Bob Dylan lined up to sing at the company’s funeral party. Fairfax stared down regulators and fought back. Dylan never got the chance to sing.

Watsa, now 75, stole a page from Warren Buffett in building a $45 billion global empire built on value investing and insurance assets. Its bold and creative trades are legendary, often moving against the herd and making billions while others lose their shirts. These days, the company is back winning billion-dollar bets, but away from the headlines. The Fairfax Way explores the lessons learned and why skies are now blue above a transformed company.

In its 39-year history, Fairfax’s annual compound return of 19.2% trounces the S&P 500’s 11.3%. Lately, it is outperforming even Silicon Valley tech stocks and winning back an investor following. It’s time to get to know Fairfax better.

Based in Toronto and one of the top 20 insurance groups worldwide, its largest footprint is in the U.S. The global reach of its investments includes heavy exposure to India, an emerging economic powerhouse. Strategic investments include banks in Greece and Egypt, as well as Seaspan container shipping.

In its home market, consumers would be surprised to find Fairfax listed as owner of such well-known brands as Bauer hockey sticks, William Ashley wedding gifts, Sleep Country mattresses and Golf Town stores. If you took the family out for Swiss Chalet chicken last week or met a client for steak at the Keg, you were eating at Fairfax restaurants.

It’s time to get to know Prem Watsa better, too. Fate led to his arrival in Canada at the age of 22, with $8 in his pocket and an acceptance into the MBA program at Ivey business school in London, Ontario. He didn’t know what a stock was but discovered he was really good at investing so he ran with it.

People long misjudged him as a recluse. Truth is, he simply always wanted to build a business — not talk to the media or seek the spotlight. After 40 years, he and his executives have finally decided it’s a good time to open up. One reason he cooperated on the book was to have a document for the future, one that would be there to scare off anyone with an idea to break up the company. He built it to grow, compound and to give back.

For all the colourful dealmaking, billion-dollar bets and high-stakes hedge fund wars, Thomas reveals an inspiring story for our current troubled times. Watsa and Fairfax have often been misunderstood. In reality, many people just had trouble believing they had the audacity to build a company culture based on the golden rule—treat others as you would have them treat you. This book captures the inside story of how a culture of treating people right can be a secret competitive moat to long-term outperformance.

November 12, 2025

Why Prem Watsa and Fairfax are ready to talk

After 40 years, a legendary entrepreneur had opened up for the first time on the whole Fairfax Financial story. When people find out I wrote The Fairfax Way, they usually respond one of two ways, with:

* A blank stare: “Who’s Prem Watsa/Fairfax?” (It’s amazing they are still off the radar for many.

* Their eyebrows raised: “Why now? How did you get him to talk?” (These people know how media shy Fairfax is. The better they know Prem and the company, the more surprised they are.)

Truth is, it took some time to get to yes. I walked into the picture because Prem and I had been having discussions about the idea of compassionate capitalism – including how his company had been actively founded on the notion of being a ‘good company’ that could treat employees and partners right. Make money, treat people right and give back. That’s it. Do good by doing well. I wrote up our interview in the National Post but we kept on talking and it turned into a book.

Buy The Fairfax Way here.

So, I didn’t have to ‘get him to talk’. But it took time to earn their trust, then they left me alone to write the kind of book that I thought was right. But why now? Prem wanted a history for employees. Always wired for long-term thinking, he reasoned that, if I got it right, it would also help reinforce the vision for the company’s future leaders and board members, as well as repel pesky activists who like breaking up companies to unlock short-term value.

Now 75, Prem has big plans for at least another century of Fairfax. He knows the temptation will be too strong for some to resist messing with what he and others have built. and figures if I got the story right, it would be one more way to scare off any plots.

So there, that is the why now (and why me) background story. Stay tuned for more on how the little kid from Hyderabad arrived in London, Ontario and the wild ride to end up on top by doing things a different way – no raiding, no egos and no swearing. Weird for a company built on M&A, right? People thought they were a cult. And the fact they didn't see value in talking to the media fed that view.